Global memory chip demand is expected to remain exceptionally high for the next several years, according to industry experts and recent market performance. Samsung Electronics, a leader in the semiconductor industry, has indicated that this growth cycle will likely persist through 2026 and extend well into 2027. This sustained interest is largely fueled by the rapid expansion of artificial intelligence technology and its increasing integration into various consumer and enterprise sectors.

The optimistic outlook follows a period of explosive financial growth for the sector. In late January 2026, Samsung reported that its quarterly profit had tripled, reaching a new record high. This financial milestone was primarily driven by the massive surge in artificial intelligence development. AI servers require specialized, high-performance memory chips to process vast amounts of data, and the market has seen a consistent rush to secure these vital components.

Artificial intelligence fuels record-breaking profits

The current landscape of the tech industry is being reshaped by the specific needs of artificial intelligence. High-ranking executives at Samsung Electronics have noted that the demand for memory chips is no longer following traditional cyclical patterns. Instead, the need for high-bandwidth memory and advanced storage solutions for AI data centers is providing a more consistent and powerful foundation for growth.

This trend has significantly impacted the company’s bottom line. The record-high profits announced at the start of 2026 highlight a shift in how the industry operates. As businesses and governments continue to invest in AI infrastructure, the specialized hardware required to run these systems remains in short supply. This has allowed major manufacturers to see unprecedented returns on their semiconductor investments.

Global supply chain faces looming memory shortages

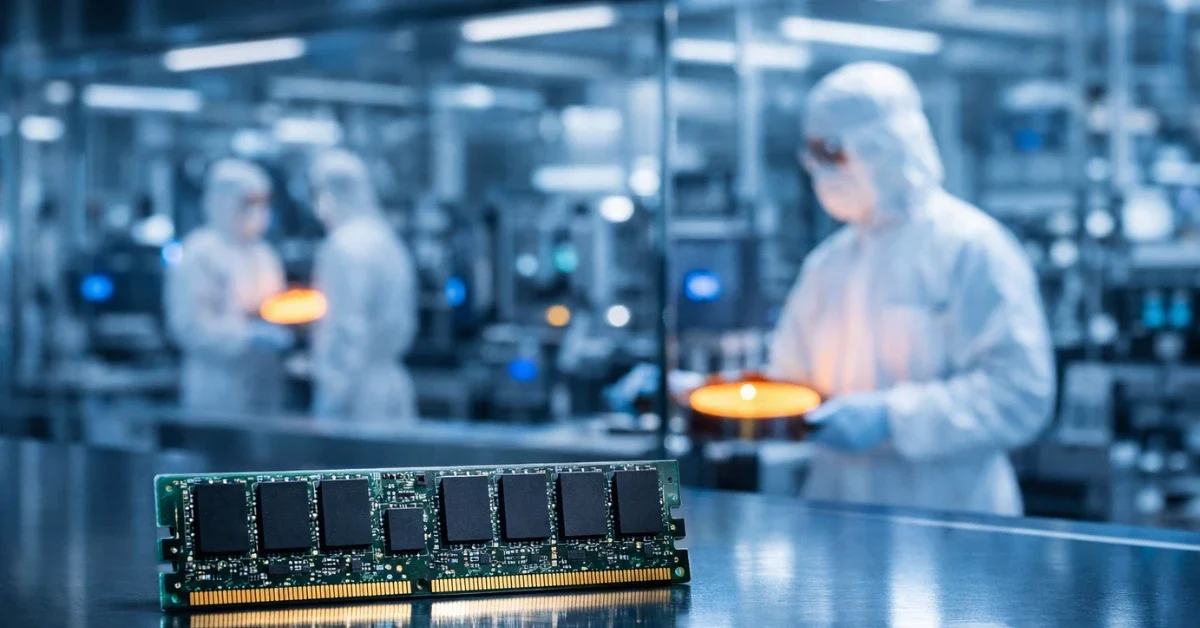

While the financial news is positive for manufacturers, the sheer scale of memory chip demand is creating ripples across the global supply chain. Reports from early 2026 suggest that a significant shortage of RAM is beginning to take hold. This supply-demand imbalance is becoming a major concern for companies that rely on consistent access to semiconductor components to build their products.

The shortage is not just a result of high demand but also the complexity of manufacturing the next generation of memory modules. As AI continues to consume a larger portion of the available production capacity, other sectors of the electronics market are finding it difficult to secure the parts they need. This competition for resources is expected to define the market throughout the remainder of 2026 and into 2027.

Impact on smartphones and gaming computers

For everyday consumers, the current market conditions may soon lead to higher prices for popular electronic devices. Analysts and industry observers are warning that the cost of smartphones and PC gaming hardware is likely to rise as a direct result of the memory scarcity. High-end mobile phones and gaming rigs require large amounts of RAM to function effectively, making them particularly vulnerable to component price hikes.

Manufacturing costs are increasing as companies struggle to outbid one another for limited inventory. When the cost of these essential parts goes up, those expenses are frequently passed on to the buyer. Consumers looking to upgrade their devices in 2026 may find that the latest models carry a higher price tag than previous generations, or that certain high-performance configurations are harder to find in stock.

Long-term outlook for the semiconductor market

The transition into 2026 has marked a turning point for the semiconductor industry. While past years often saw periods of oversupply followed by price crashes, the current era of AI-driven growth appears more durable. Samsung executives believe that the industry is entering a prolonged phase where demand will continue to outpace supply for the foreseeable future.

This two-year forecast, stretching into 2027, suggests that the industry will continue to prioritize high-margin AI chips. While this focus drives innovation and record profits, it also requires careful navigation by other tech sectors. As the market adapts to these new realities, the balance between technological advancement and consumer affordability will remain a key focus for the global tech economy.